story and photo from Public News Service

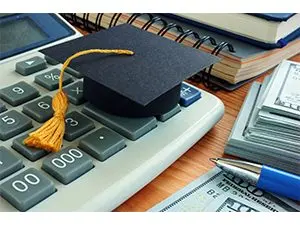

As 2025 comes to a close, millions of Americans with student loans in default are about to face repayment again.

Starting next month, the U.S. Department of Education will begin sending notices for administrative wage garnishment to borrowers who are in default on federally backed student loans. That applies to loans that have gone unpaid for at least 270 days.

Nationwide, nearly 43 million borrowers are affected. In Indiana, roughly 900,000 people hold student loan debt totaling more than 30 billion dollars.

The federal government will use the Treasury Offset Program to collect overdue balances. That can include garnishing wages, federal tax refunds, Social Security benefits, or other government payments.

Borrowers do have options. Those in default can contact the Department of Education’s Default Resolution Group to explore repayment plans and loan rehabilitation. Making on-time payments under a new plan can help bring a loan out of default.

For borrowers still in school or facing hardship, deferment or forbearance may also be available.